GST Consulting in Delhi

GST Audit, Annual return and to provide GST Reconciliation.

PFA two formats for your reference!

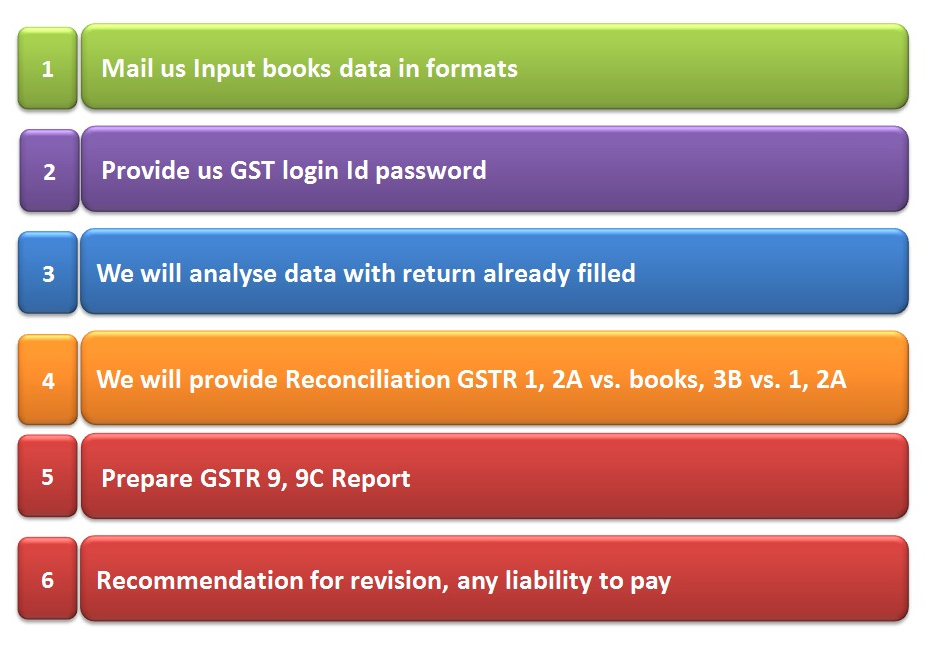

We need actual books data in the desired given format, and GST login id password for analysing of GSTR1 & 3B already submitted.

Purchase data includes all input, input services and capital goods purchases.

Our Deliverables:-

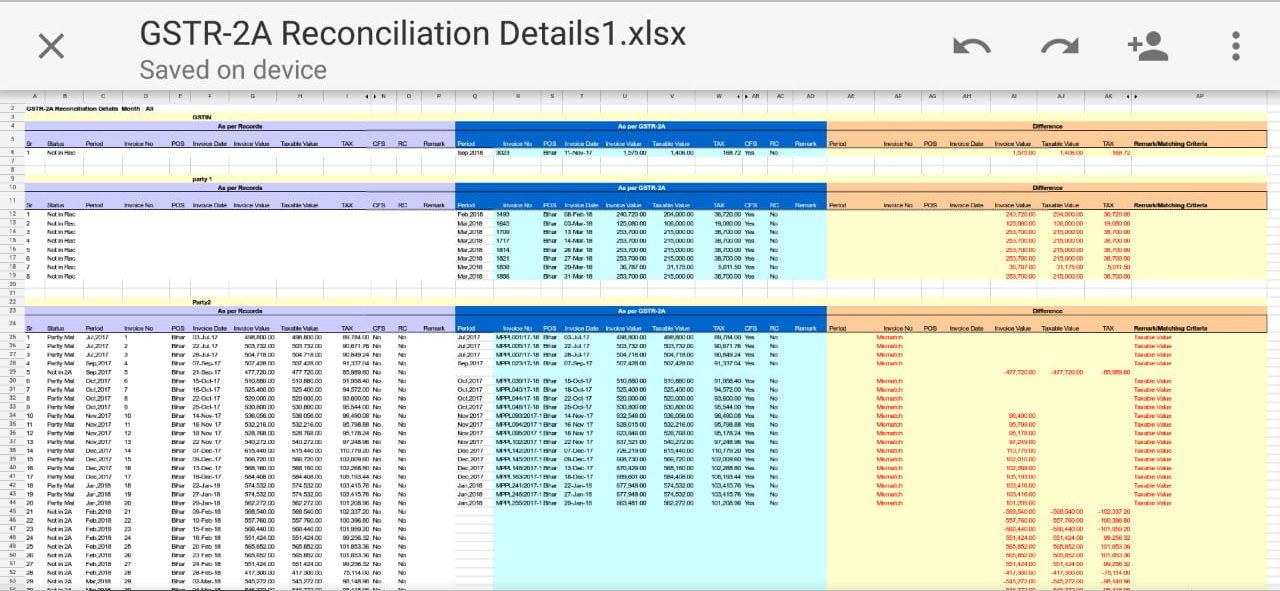

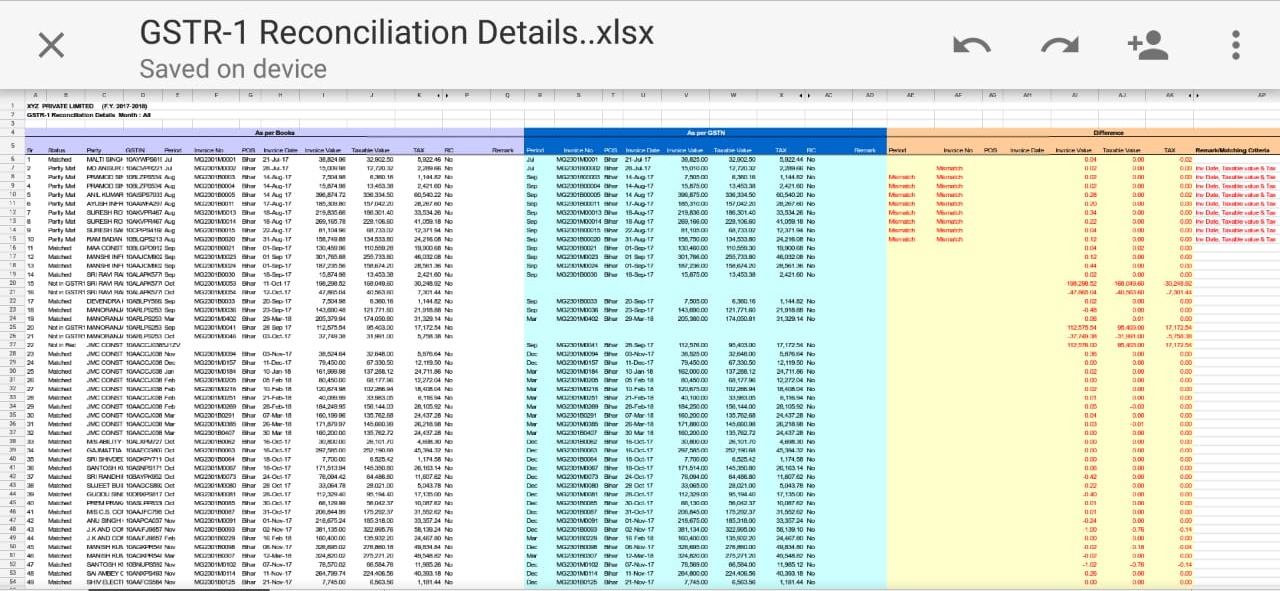

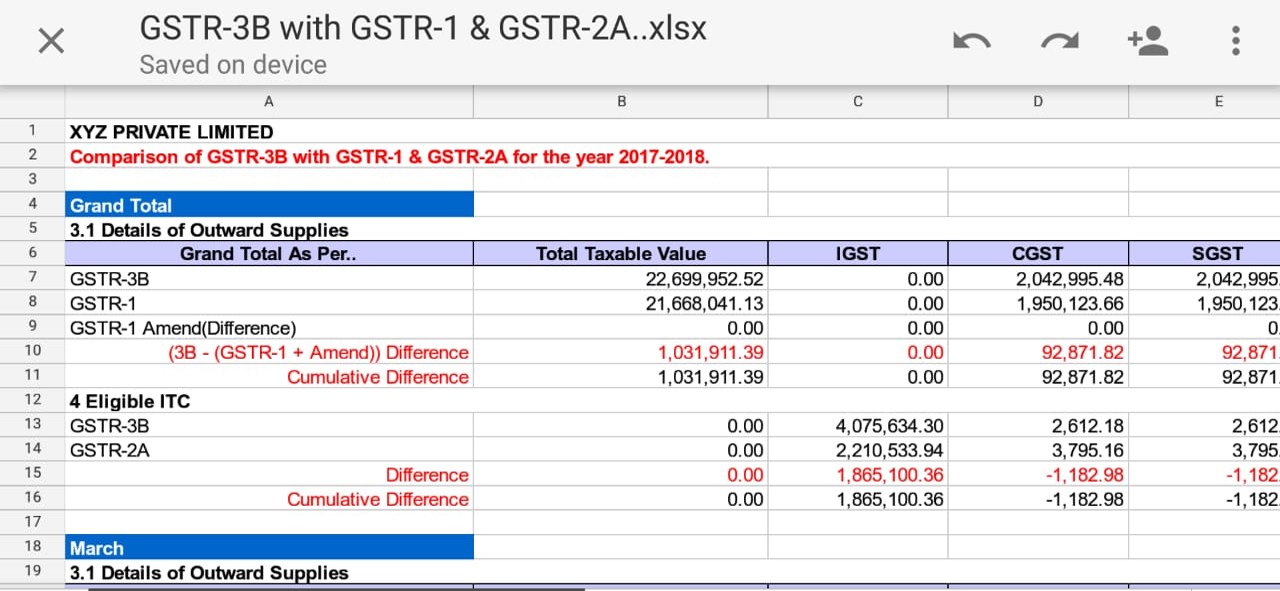

- Reconciliation of GSTR1 with 3B, 3B vs 2A.

- Preparations of GSTR 9

- Reconciliation statement and ascertain any liability to pay.

- GST Audit 9C.

- Recommendation for ammendment in GSTR1 & 3B

Further information if required, checklist will be provided after preliminary assessment of data.

Any help desired for updating data in given format, feel free to call us.

These two format client fill send over mail

GST in India

India is noted for its intricate and complex tax structure. The much talked about ‘GST in India’ triggered the tax structure to eliminate the multiplicity of the taxes and their cascading effects and to harmonize the Center and State tax administration. GST is an indirect tax reform, which aims to remove tax barriers between states and create a single market. It is collected on value added at each stage of supply chain right from production till distribution.

The current tax structure is undetermined and uncertain due to multiple rates, which further leads to multiple forms. However, GST will replace all the various indirect taxes and bring them under one umbrella to make compliance easier. GST in India is perhaps India’s most revolutionary and detailed tax reform ever and has been envisioned as an efficient tax system making India one unified common market.

India is a federal country where both the Center and the States have been delegated the powers to collect or levy taxes. Both the levels of Government have separate responsibilities to fulfill and perform, as per the Constitution, for which they need to raise resources. A dual GST will, therefore, be keeping with the Constitutional requirement of fiscal federalism. The Center and State will be simultaneously levying GST on each activity.

GST in India will have two components- Central GST (CGST) and State GST (SGST). The Central GST and State GST will simultaneously be applied on every transaction of supply of goods and services except on goods and or services, which are exempted and lie outside the realm of GST. However, IGST will be levied on inter state sales and imports. It will be shared equally between the Center and the State.

The Goods & Services Tax (GST) will be imposed at various rates ranging from 0% to 28%. The GST Council decided a four- tier tax structure of 5%, 12%, 18% and 28% with lower rates for the necessities and the essential items and the highest for inessential and luxurious merchandise, having a significant impact on every consumer and every industry. Activities such as traveling, eating out, phone bills, banking and insurance will be seen on the higher budget side whereas buying cars, movie tickets, processed food, cement will be seen on the lower end.

India finally seems to be on the edge of executing the much-awaited tax reform of GST in India. With the passing of the CGST Act, 2017, IGST Act,2017, UTGST Act, 2017, we moved a step closer to the benefit of the country bringing uniformity. If executed well, GST in India will help improve the nation’s economy and help make the process of levying taxes effective and efficient and in effect, help achieve – ‘ONE NATION, ONE MARKET, ONE TAX.’

GST a Game Changer

Goods & Services Tax (GST) is a game-changer reform for the Indian economy as it will help to develop a common Indian market and reduce the cascading effect of tax on the cost of goods and services. Implementation of GST in India will impact the Tax Structure, Tax Incidence, Tax Computation, Tax Payment, Compliance, Credit Utilization and Reporting, leading to a complete overhaul of the current indirect tax system.

Our Indirect tax team comprehends a thorough understanding of the evolving Goods & Services tax law and its emerging trends and issues in various sectors and their impact on clients’ businesses.

This paradigm shift to Goods & Services Tax in India will lead to far reaching impacts on different business processes including operations, supply chain model contractual agreements, pricing, information technology, human resource & tax compliances.

Business houses need to be ready for smooth transition to GST and prepare a roll out plan.

Effective transition planning needs engagement with concerned team, providing training, compliance manuals, imparting education of the system and practical action points.

Here is an indicative glimpse of services we offer, in light of a dynamic and evolving regulatory environment surrounding Goods & Services Tax:

- Overview assessment of different business functions and operations in order to be better prepared for GST transition.

- Assistance and advice for diagnostic / impact analysis to assess the operational, commercial and financial impact of GST

- Assistance and support in planning transition to GST including on the prevailing ERP.

- Migration of existing assessees under GST and Registration of new dealers under GST

- Presenting updates on regular basis on implementation, Model GST law and other legal aspects & clarifications on Indian GST provided by Government.

- Support on Compliance with filings and records as may comprehensively be required under the GST regime.

- Review of how and in what manner the GST levies would be dovetailed into GST, and also to plug in any existing leakages and gaps in the present regime.

Who is required to file GST Annual return

Comment :

Who is not required to file GST Annual returnThe Annual return is not required to be filed by

Every e-commerce operator required to collect tax at source under section 52 of CGST Act shall furnish annual statement in form GSTR-9B – Rule 80(2) of CGST and SGST Rules, 2017. Time to file Annual return under GSTAnnual return has to be filed by 31st December following the close of financial year as per section 44(1) of CGST Act. Late Fees if Annual return under GST is not filed within timeLate fees to be paid is Rs 100 per day subject to Maximum of 0.25% of Turnover in the State or Union territory. Refer Section 47(2) of CGST Act 2017 which says Any registered person who fails to furnish the return required under section 44 by the due date shall be liable to pay a late fee of one hundred rupees for every dayduring which such failure continues subject to a maximum of an amount calculated at a quarter per cent of his turnover in the State or Union territory. Comment : Late fees is Rs 100 per day under CGST subject to Maximum of 0.25% of Turnover in the State or Union territory under CGST and Rs 100 per day under SGST subject to Maximum of 0.25% of Turnover in the State or Union territory under SGST. Annual return in form GSTR-9An annual return as specified under section 44(1) of CGST Act will be filed electronicallyin form GSTR-9 through the Common Portal either directly or through a Facilitation Centre. – rule 80(1) of CGST and SGST Rules, 2017. Comment : This annual return is for Regular Taxpayers. Annual return in form GSTR-9AA person paying tax under section 10 of CGST Act (composition scheme) shall furnish the annual return in form GSTR-9A – proviso to rule 80(1) of CGST and SGST Rules, 2017. Annual return in form GSTR-9BEvery e-commerce operator required to collect tax at source under section 52 of CGST Act shall furnish annual statement in form GSTR-9B – Rule 80(2) of CGST and SGST Rules, 2017. [ Note ,As on date(27.05.2018) the Govt has not yet released the format of GSTR 9B ] Annual return in form GSTR-9CAudit report in form GSTR-9C if aggregate turnover exceeds Rs two croresEvery registered person who is required to get his accounts audited in accordance with the provisions of section 35(5) of CGST Actshall furnish, electronically, the annual return under section 44(1) along with a copy of the audited annual accountsand a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement,and such other particulars as may be prescribed – section 44(2) of CGST Act. Every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section 35(5) of CGST Act and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in form GSTR-9C, electronically – Rule 80(3) of CGST and SGST Rules, 2017. GSTR-9C Download GSTR-9 Download GSTR-9A Download |