Strike Off Company

All you need to know

When the Company has incorporated a Certificate of Incorporation is issued by the Registrar of Companies which acknowledges the existence of the Company. Once the name of the company is entered into registrar it cannot be removed unless the company applies for it or processed by law. When the company fails to commence its business or fails to submit yearly returns, the registrar by its own may put the name of the company into strike off.

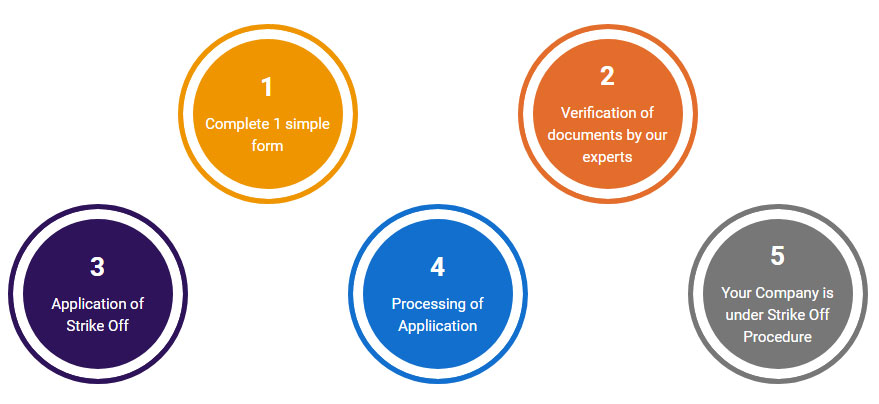

The process of removing an incorporated or registered company from the register kept by the governing statutory agency such as a registrar of companies. Application for the strike off can be made by the Company who is actively working and also by a dormant company. You may get in touch with our compliance manager on +919458809281 or email india@globaltaxation.in for free consultation.

Major changes in Strike off of Companies by MCA:

- MCA fees doubled from now i.e from 5000₹ to 10000₹.

- All necessary compliances have to be done before filing STK-2.

- Before filing STK-2, annual returns and financial statements needed to be filed upto the end of financial year in which company cease to carry on its business.

- If company wants to file STK-2 after the action been initiated by ROC under section 248(1) then company needs to file all over due returns in AOC-4 and MGT-7.

- Statement of account needed to be given in stk-8 format only.

- If notice issued under STK-7 by ROC, then company cannot file STK-2.

- In STK-4 one point to be added as company has fulfilled all pending compliances,if any ( only applicable in case an application under section 248(2) has been filed after the initiation of action under 248(1).)

Simple Prices | No Surprises

Choose Your Package

ESSENTIAL

14999/- (All Inclusive)

- Wind up a company with no transactions since incorporation

ENHANCED

18999/- All Inclusive

- Wind up a company with NIL Transactions

- One year annual filing of forms

- One year Income tax return

ULTIMATE

24999/- All Inclusive

- Wind up a company with Transactions of upto Rs. 100 Lakh

- One year annual filing of forms

- One year Income tax return