Branch Office Foreign Company

Foreign companies engaged in manufacturing and trading activities abroad are allowed to set up Branch Offices In India for the following purposes:

- Export/Import of goods.

- Rendering professional or consultancy services.

- Carrying out research work, in which the parent company is engaged.

- Promoting technical or financial collaborations between Indian companies and parent or overseas group company.

- Representing the parent company in India and acting as buying/selling agents in India.

- Rendering services in Information Technology and development of software in India.

- Rendering technical support to the products supplied by the parent/ group companies.

- Foreign airline/shipping company.

A body corporate incorporated outside India (including a firm or other association of individuals), desirous of opening a Branch Office (BO) in India have to obtain permission from the Reserve Bank under provisions of FEMA 1999. The applications from such entities will be considered by Reserve Bank under two routes:

Reserve Bank has granted general permission to foreign companies to establish Project Offices in India, provided they have secured a contract from an Indian company to execute a project in India, and

- Reserve Bank Route

Where principal business of the foreign entity falls under sectors where 100 per cent Foreign Direct Investment (FDI) is permissible under the automatic route.

- Government Route

Where principal business of the foreign entity falls under the sectors where 100 per cent FDI is not permissible under the automatic route. Applications from entities falling under this category and those from Non-Government Organisations/Non-Profit Organisations/Government Bodies/Departments are considered by the Reserve Bank in consultation with the Ministry of Finance, Government of India

The following additional criteria are also considered by the Reserve Bank while sanctioning Liaison/Branch Offices of foreign entities:

Track Record

- Track Record

A profit making track record during the immediately preceding five financial years in the home country

- Net Worth

Total of paid-up capital and free reserves, less intangible assets as per the latest Audited Balance Sheet or Account Statement certified by a Certified Public Accountant or any Registered Accounts Practitioner by whatever name.

For Branch Office - not less than USD 100,000 or its equivalent.

Applicants who do not satisfy the eligibility criteria and are subsidiaries of other companies can submit a Letter of Comfort from their parent company as per, subject to the condition that the parent company satisfies the eligibility criteria as prescribed above.

The Branch/Liaison offices established with the Reserve Bank's approval will be allotted a Unique Identification Number (UIN).

The BOs/LOs shall also obtain Permanent Account Number (PAN) from the Income Tax Authorities on setting up the offices in India.

Branch Office in Special Economic Zones (SEZs)

Reserve Bank has given general permission to foreign companies for establishing branch/unit in Special Economic Zones (SEZs) to undertake manufacturing and service activities. The general permission is subject to the following conditions:

- such units are functioning in those sectors where 100 per cent FDI is permitted.

- such units comply with chapter -22 of the Companies Act, 2013 (Section 379 onwards).

- such units function on a stand-alone basis.

SUBMIT REQUEST llet we assist you in setting up branch office of Foreign Company.

Permissable Activities Branch Office

Companies incorporated outside India and engaged in manufacturing or trading activities are allowed to set up Branch Offices in India with specific approval of the Reserve Bank. Such Branch Offices are permitted to represent the parent/group companies and undertake the following activities in India:

- Export/Import of goods.

- Rendering professional or consultancy services.

- Carrying out research work, in areas in which the parent company is engaged.

- Promoting technical or financial collaborations between Indian companies and parent or overseas group company.

- Representing the parent company in India and acting as buying / selling agent in India.

- Rendering services in information technology and development of software in India.

- Rendering technical support to the products supplied by parent/group companies.

- Foreign airline/shipping company.

Normally, the Branch Office should be engaged in the activity in which the parent company is engaged.

- Retail trading activities of any nature is not allowed for a Branch Office in India.

- A Branch Office is not allowed to carry out manufacturing or processing activities in India, directly or indirectly.

- Profits earned by the Branch Offices are freely remittable from India, subject to payment of applicable taxes.

SUBMIT REQUEST llet we assist you in setting up branch office of Foreign Company.

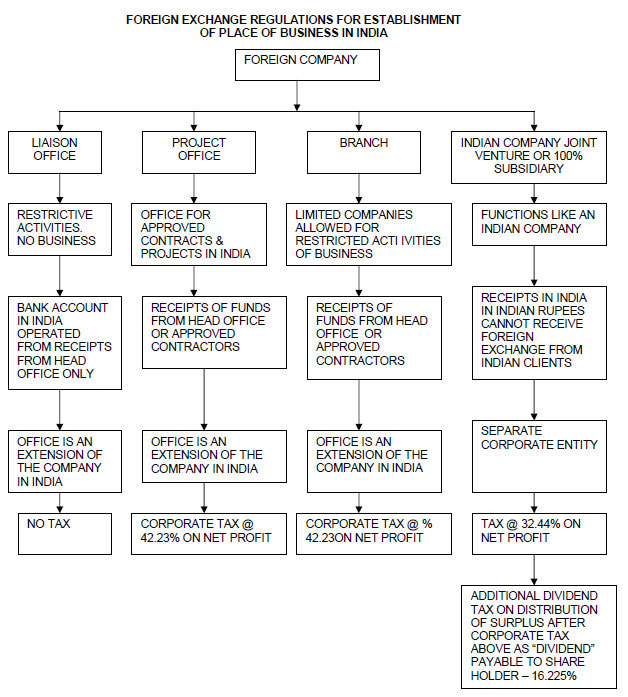

TAX Structure