what is nidhi company?

Nidhi Rules with effect from 15th August 2019.

DECLARATION OF NIDHI Newly introduced Rule 3A of Nidhi Rules, 2014 bring a harmonious solution in both definitions of the Nidhi. It permits fresh incorporation of companies as Nidhi and Declaration of existing companies as Nidhi.

1. EXISTING PUBLIC COMPANY AS NIDHI A public company may make an application in Form NDH-4 for declaring it as Nidhi. The Central Government on being satisfied that the company meets the requirements under these rules shall notify the company as a Nidhi in the Official Gazette. [Rule 3A]

2. NIDHI TO BE INCORPORATED AS SUCH A Nidhi incorporated under the Act shall file application Form NDH-4 within sixty days from the date of expiry of:

- (a) one year from the date of its incorporation; or

- (b) the period up to which extension of time has been granted by the Regional Director under sub-rule (3) of rule 5. [First Proviso Rule 3A]

This rule shall apply for the Nidhi incorporated on or after the commencement of the Nidhi (Amendment) Rules, 2019.

A Nidhi may also file Form NDH – 4 before completion of one year. [Second Proviso Rule 3A]

In case a company (Nidhi) does not comply with the requirements of this rule, it shall not be allowed to file Form SH-7 (Notice to Registrar of any alteration of share capital) and Form PAS-3 (Return of Allotment). [Third Proviso Rule 3A]

3. DECLARATION BY EXISTING NIDHI Rule 23A Require a Declaration under Form NDH – 4 by Following two classes of companies:

Every Nidhi incorporated as Nidhi under the Companies Act, 2013; and every other company functioning on the lines of a Nidhi company or Mutual Benefit Society but has either not applied for or has applied for and is awaiting notification to be a Nidhi or Mutual Benefit Society under sub-Section (1) of Section 620A of the Companies Act, 1956 These Companies shall also apply to got themselves declare as Nidhi within a period of one year from the date of its incorporation or within a period of six months from the date of commencement of Nidhi (Amendment) Rules, 2019, whichever is later.

The last date for application NHD – 4 shall be 14th February 2020.

4. RE-DECLARATION/UPDATION AS NIDHI Rule 23B stipulates that every company referred in clause (a) of rule 2 shall file Form NDH – 4 updating its status. No Fee shall be charged in case of an application filed within 6 months from the date of incorporation of Nidhi (Amendment) Rules, 2019. The last date for application NHD – 4 without fee shall be 14th February 2020. Thereafter these companies may file NHD – 4 on payment of an applicable fee.

CONCLUSION It seems to be an exercise of database management and compliance monitoring system. Every company to be operated or operating as Nidhi should file Form NDH – 4 either before 14th February 2020 or within one year of its incorporation as Nidhi under the Companies Act, 2013.

Nidhi Company is a company registered under the Companies Act, 2013, which has a sole objective of cultivating the habit of thrift and savings amongst its members. This company is recognized under Section 406 of the Companies Act, 2013.Nidhi companies are allowed to take deposit from its members and lend to its members only. Therefore, the funds contributed for a Nidhi company are only from its members (shareholders) and used only by the shareholders of the Nidhi Company.

Get compliance NDH-4 Appllicable from 15.8.19 MCA notifies Nidhi (Amendment) Rules, 2019 and notified new FORM NDH-4 i.e Form for filing application for declaration as Nidhi Company and for updation of status by Nidhis.

“3A. Declaration of Nidhis .— The Central Government, on receipt of application (in Form NDH-4 along with fee thereon) of a public company for declaring it as Nidhi and on being satisfied that the company meets the requirements under these rules, shall notify the company as a Nidhi in the Official Gazette:

23A. Compliance with rule 3A by certain Nidhis:– Every company referred to in clause (b) of rule 2 and every Nidhi incorporated under the Act, before the commencement of Nidhi (Amendment) Rules, 2019, shall also get itself declared as such in accordance with rule 3A within a period of one year from the date of its incorporation or within a period of six months from the date of commencement of Nidhi (Amendment) Rules, 2019, whichever is later!

Does Nidhi Company require Reserve Bank of India (RBI) approval to register in India?

No, Nidhi Company does not require any RBI approval for its registration in India. Nidhi Company is one of the categories of NBFC which has been specifically exempted by the RBI from its core provisions including registration requirement etc.

Nidhi companies are exempted from the core provisions because Nidhi Companies are governed by the Nidhi rules, 2014. These rules are very stringent in nature. One of the important conditions of Nidhi Company is that it can deal only with its members; it can take deposits only from its members and can advance loans to its members.

Features of Nidhi Company

A Nidhi must be –

- A company,

- Incorporated as a Nidhi,

- With the object of cultivating the habit of thrift and saving amongst its members,

- Receiving deposit from and lending to its members only,

- For their mutual benefit,

- Complies with such rules.

Advantages of Nidhi Company Registration

| S.No | Advantages | Description |

|---|---|---|

| 1 | No External Involvement in Management | Outsiders are not allowed to intervene in the working of Nidhi Company for availing credit or deposit money because these companies are managed by their members only. |

| 2 | Easy Formation | No need to obtain license from RBI like other NBFCs. |

| 3 | Helpful for Lower and Middle Classes | Nidhi company charges a lower rate of interest from their members. |

| 4 | Minimum Documentation and Formalities | Loans and savings are facilitated by the minimum documentation and formalities. |

Registration Process Of Nidhi Company

| S.No | Steps | Description |

|---|---|---|

| 1 | Digital Signature Certificate | Propose Directors of Nidhi Company should have a digital signature and digital signature will use to file the registration, ROC compliance forms and Tax returns. |

| 2 | Director Identification Number (DIN) | DIN is mandatory to form a company, when a Digital Signature is approved and you will get an approval email from ROC that you are now eligible to be a director of a company. |

| 3 | Name Approval | File a Name Approval form to ROC on your behalf in form INC. 1. It takes 2 to 3 working days to get approval from the Registrar of Companies. |

| 4 | Final Incorporation Form |

After Name approval from ROC, we will find a final incorporation form with all supporting documents like registering address proof, Declaration from Directors. A Company can be incorporated online by filling the Simplified Proforma for Incorporating Company Electronically (SPICE) form in Form INC-32 (using Digital Signature Certificate of the Director)along with (eMoA) in Form INC-33 and (eAoA) in Form INC-34. |

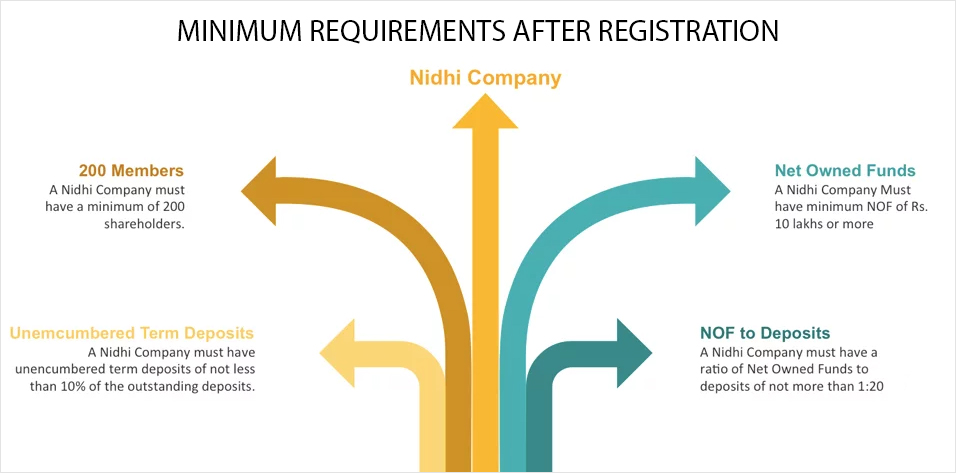

mandatory requirement of nidhi company registration

- Minimum 7 shareholders

- Minimum 3 Directors

- Minimum Capital of Rs. 5 lacs

- DIN for all Directors

- Members are only Individual

- Minimum number of 200 members

- Net Owned fund must be of Rs. 10 lakhs and above

- Minimum Capital of Rs. 5 lacs

- Unencumbered deposits of not less than 10% of the outstanding deposits

- Net own fund vs deposits should not be more than 1:20

top nidhi companies in india

- Maben Nidhi Limited

- Muthoottu Nidhi (Kerala) Limited

- Mini Muthoottu Nidhi Kerala Limited

- Kalayil Nancy Nidhi Limited

top nidhi companies in india

There are some restrictions on Nidhi Companies under Nidhi Rules, 2014. According to Rule ‘6’ of Nidhi Rules, 2014, a Nidhi Company shall not:

-

Carry on the Business of

- Chit Fund,

- Hire Purchase Finance,

- Leasing Finance

-

Issue

- Preference Shares,

- Debentures or

- Any other debt instrument by any name or in any form whatsoever;

- Open any Current Account with its members;

-

Acquire another company by;

- Purchase of securities or

- Debentures or

- Control the composition of the Board of Directors of any other company in any manner whatsoever or

- Carry on any business other than the business of borrowing or lending in its own name.

- Accept deposits from or lend to any person, other than its members;

- Must not pledge any of the assets that have been lodged by its members as security;

- Take Deposits from or lend money to anybody corporate;

- Enter into any Partnership Arrangement in its borrowing or lending activities,

- Issue or cause to be issued any advertisement in any form for soliciting deposit,

- Pay any brokerage or incentive for mobilizing deposits from members or for deployment of funds or the granting loans.

compliances for nidhi company

| S.No | Form No | Description |

|---|---|---|

| 1 | NDH-1 |

Annual Compliances of Return Within 90 days of the close of First Financial Year after its incorporation. This form shall be duly certified by Company Secretary in Practice or Chartered Accountant in Practice or Cost Accountant in Practice. |

| 2 | NDH-2 |

Extension to Regional Director if unable to comply within 90 days Within 30 days from the close of First Financial year. |

| 3 | NDH-3 |

Half Yearly Compliances Within 30 days from the close of Half financial year duly certified by Company Secretary in Practice or Chartered Accountant in Practice or Cost Accountant in Practice |