Company Formation

Company Formation

Looking to Incorporate company in India! let us help you in taking care of your legal business needs taking your hassle away and let you concentrate on your core business needs

| Company Formation | Private Limited | Public Limited |

|---|---|---|

| (Cost Inclusive Of Taxes) | 16,000/- | 30,000/- |

| Authorized Capital | Rs100,000 | Rs 500,000 |

|

DIN Application

(Director Identification No ) |

2 Directors | 3 Directors |

| DSC (Digital Signature of Director ) | 2 Director | 3 Director |

| Application Of Name | Yes | Yes |

| Drafting MOA & AOA | Yes | Yes |

| Certificate Of Incorporation | Yes | Yes |

| Certificate Of Commencement | Yes | Yes |

| Total Time Taken | 15 working days (Approx) | 15 working days (Approx) |

| PAN & TAN Application | Yes | Yes |

| 1 Year Corporate Advisory | Yes | Yes |

| SUBMIT REQUEST | SUBMIT REQUEST |

Legal Structure of Company in India

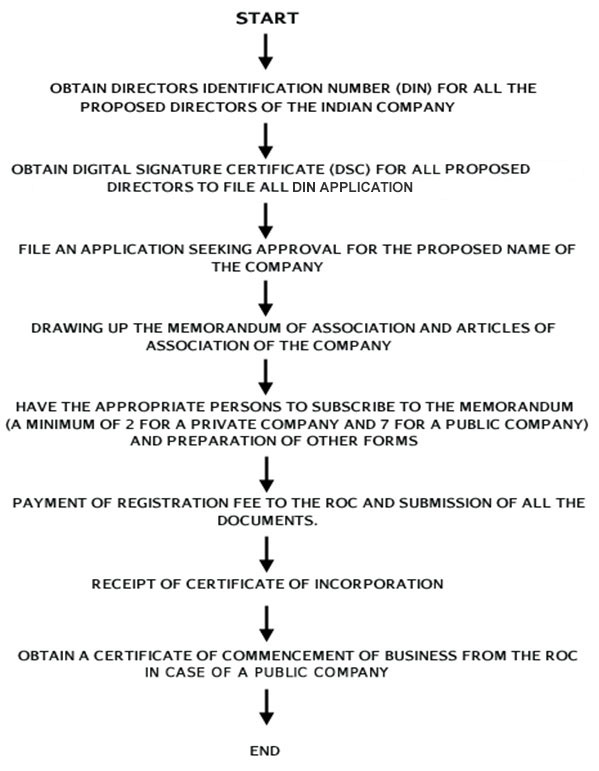

In India incorporation of company is governed as per the Provisions of Companies Act 2013 and authority approving the company registration is Registrar of Companies.

In India Company existence can be in the form of Private limited or Public limited

| Private Limited | Public limited |

|

|---|---|---|

| Minimum authorized capital required |

RS 100,000 |

Rs 500,000 |

| Registered Office |

Must be in India |

Must be in India |

|

Minimum

and Maximum Number of

Share holder

|

Minimum 2 and Maximum 200

|

Minimum 7 and Maximum No limit |

| Minimum and maximum no of Directors |

Minimum 2 And Maximum 15

|

Minimum 3 and Maximum 15

|

| Foreign Investment |

Yes as per the FDI policy ** |

Yes as per the FDI policy ** |

| Corporate Taxation rate (for upto Rs. 10 crore income) |

33.063% |

33.063% |

(However, from AY 2017-18, basic tax rate is 29% if turnover does not exceed Rs. 5 crore.) |

||

| Audit requirement |

Yes Yearly |

Yes Yearly |

| Filing of Financial Statements with the Registrar Of Companies |

Yes Yearly |

Yes Yearly |

| Acceptance of deposits |

No |

No |

| Restriction On transfer Of shares |

Yes |

No |

| Board Meeting |

Once in Every Qtr |

Once in Every Qtr |

| Annual General Meeting (Shareholders) |

Once in a Year |

Once In a Year |

**Foreign Direct Investment (FDI) in any form is prohibited in any Indian entity, whether incorporated or not, which is engaged or proposes to engage in the following activities:

- Lottery Business including Government/private lottery, online lotteries, etc.

- Gambling and Betting including casinos etc.

- Business of chit fund.

- Nidhi company.

- Trading in Transferable Development Rights (TDRs).

- Real estate business (However, FDI is permitted in development of townships, construction of residential/commercial premises, roads or bridges educational institutions, recreational facilities, city and regional level infrastructure, townships), or construction of farm houses

- Manufacturing of Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

- Activities / sectors not open to private sector investment e.g. Atomic Energy and Railway Transport (other than Mass Rapid Transport Systems).

Documents Required Company Formation

We will need following details/ documents

- PAN card copy for proposed directors for Indian resident, for Non-resident copy of Passport (self-attested).

- Address proof for proposed directors, (self-attested).

- PAN card copy for proposed shareholders for Indian resident for Non-resident copy of Passport, (self-attested)

- Address proof for proposed shareholders, (self-attested)

- One photograph of each proposed director and shareholders,

- Valid mobile No. and mail id,

- Name of the company proposed, 6 names in order of priority,

- Proposed state in which the registered office will be situated for the Company,

- Address of registered office & proof of registered address (i.e. Electricity Bill, Telephone/Mobile Bill, Gas Bill),

- Address of the police station in whose jurisdiction registered address of the company lies,

- Authorized share capital of the proposed company

- Main object for the proposed company.

- Digital signature of any one of the director.

Q1: Categorisation of company as per Companies Act 2013.

Ans: Company classification can be Public Company or Private Company

Q2: How many people are required to form a company?

Ans: Minimum 2 people are required to format a Private Limited Company and minimum 7 people are required to format a Public Limited Company named as promoter or shareholder of the company. As per recent amendment in law even a single individual can format a company known as one man Company which will be classified as a Private Company.

Q3: Do a relative of promoter can be a member in a company?

Ans: Yes, relative of promoter can be a member in a company (i.e. Relative-Spouse, Brother, Sister, Father Mother etc.)

Q4: What is the minimum amount of investment required for formation of a comapany ?

Ans: Minimum investment required for a Private Limited Company is Rs 1 Lac and Rs 5 Lac for a Public Limited Company.Investment will be in the form of subscription to equity shares of the company.

Q5: Do the functioning of the company limited to state in which registered address of the company is there?

Ans: Company once registered in a specific state can function in whole of India by opening up its branches in respective State or Union territory

Q6: Do bank account in company name has to be separately opened?

Ans: Yes, Current A/c in company name will separately open in any Bank.

Q7: Do registration with any other authority is need before starting the functioning of the company?

Ans: Industry specific registration has been prescribed by various State & Central Laws

Q8: How we determine the owner ship in the company?

Ans: Ownership of the company is defined on the basis of total % shares held by each shareholder of the company.

Q9: Who will be Directors in a company?

Ans: Directors are the Authorised representatives of the company minimum 2 Director are required to be appointed in a Private Limited Company and 3 Directors in a Public Limited Company.Directors can even be the shareholders in the company.

Q10: Do a person who is employment /job can format a company?

Ans: Yes, Company law does not prohibit person who is in employment cannot be a Director in a company. If the employment agreement which the individual has executed prohibits on accepting any other appointment then he cannot.

Q11: Do any kind of business is possible in the company?

Ans: No, Company object is defined as per the Memorandum of Association of the company which at the time of incorporation has to be clearly defined company cannot function in sector other than those as defined in the main object however the company can change its objective clause by following certain procedural requirement.

Q12: Can a Foreigner or a NRI can format a company?

Ans: Yes, on complying with certain procedural requirement.